What’s one of the fastest and most effective ways the vast majority of us can gain more financial independence?

It’s simple - take on

more responsibility when it comes to your finances.

You might be thinking, “But I’m already doing so much!” Absolutely you are! Rest assured, more responsibility doesn’t mean more worry or more work. It simply means taking clear and conscious responsibility for your financial decisions. This is part of what we mean when we talk about

mindful money.

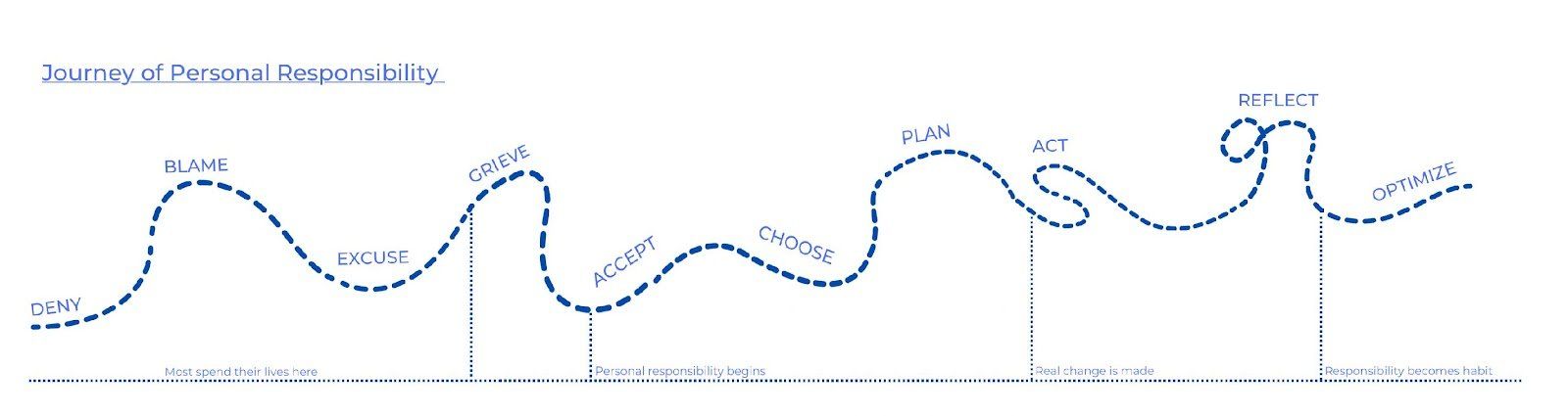

However, this is obviously easier said than done… so I’d like to invite you to imagine personal responsibility as a journey, albeit a very bumpy ride where most of us will oscillate between different stages at various times.

There are many stages on the journey of personal responsibility, so this guide will help you navigate through them, and see how each connects to our finances:

- Deny

- the default reaction to a situation we don’t want to face and aren’t being forced to immediately deal with. Since money problems tend to mount over time, denial about finances is one of the easiest traps to fall into.

It doesn’t have to be as obvious as, ‘My finances aren’t as bad as I think they are.’ It can be subtle: ‘It’ll sort itself out’/‘There’s nothing I can do about it anyway.’ Denial can also manifest in the form of not allowing ourselves or those around us to enjoy money.

We can move away from denial by confronting reality. Mindfulness can help prepare us for this by calming our fears and boosting our confidence so we know we’ll be able to overcome any difficulties we encounter.

- Blame

- naturally arises from the anger felt when we realize influential figures in our lives once instilled in us money lessons that work against our best interest. Unfortunately, it’s easy for many of us to get stuck at this stage of the journey because of how unfair the situation can be, and far too many spend the majority of their lives stuck in the blame stage of personal responsibility.

We can easily feel disadvantaged if we were given damaging money lessons that others weren’t. However, it’s important to remember that this is just an unhealthy comparison and that it’s never really possible to know the full extent of someone else’s experience, what they were taught or how they learned.

Plus, it’s possible to undo any bad money lesson we were taught without the need to blame by making a commitment to learning better ones, and it’s possible that gaining the ability to teach yourself is an advantage that others don’t have.

Blame is a stage we should get out of as quickly as possible, though - it’s a useless idea that zaps the energy we could use to improve our financial lives.

Excuse - the opposite of blaming, and while excusing might feel like a nicer way to confront a problem, it’s really a way of dancing around one.

Excusing is synonymous with rationalizing or justifying. It’s when we convinced ourselves we needed to buy the expensive television when the one for less money showed pretty much the same thing. Or if we let ourselves rack up credit card debt because ‘it’s how we were taught.’

Excusing ourselves for poor habits will inadvertently reinforce them. There’s a comfort to this because even in a bad habit, there’s usually one small thing that’s working (despite everything else being ineffective), so reaching for an excuse when we make a poor financial decision can temporarily mitigate negative emotions like shame and disgust. However, excusing doesn’t actually address problems, and therefore allows them to continue.

- Grieve

- the feeling that comes once we realize our lessons are obsolete and that we could have been taught differently. However, it’s important to remember that loss associated with money grief isn’t real.

The feeling stems from ideas about who we would have been, how rich we could have been, if only we’d had different upbringings. This is useless, though, and does a better job of reflecting our imaginations than our realities.

The more we grieve the imaginary opportunities we lost because of the money lessons we were never taught, the more we actually lose the real opportunity to dig into our inner money wisdom and do something about our financial destiny.

- Accept

- what happens when we offer no resistance to the details of what's happening around us. Acceptance doesn’t have to involve feelings of any kind, though it can. And it’s important to accept everything exactly as it comes to you without trying to change it in anyway.

This is especially true for our finances because we’re dealing with numbers. We need to know exactly what they are in order to manage them effectively.

Acceptance can feel like giving up because, accepting things as they are means realizing our existing ideas were only one part of the picture, but it allows us to progress on the journey.

Anytime we want to improve our finances, or anything else in life for that matter, acceptance is how we must begin.

- Choose

- realizing that we have the power to make choices for ourselves that we didn’t think we could is how to progress toward the greater responsibility that leads to greater wealth.

Consciously focusing on the choices available to us is how we prevent ourselves from falling back on bad habits, how we expand our opportunities to create value, and how we build a new sense of ourselves that reflects ourselves as we want to be instead of who we’ve been told we are.

Personal responsibility is really about committing to who you personally want to be, and doing what needs to be done to get there.

- Plan

- plans are the simplest, but most overlooked part of managing our finances.

They’re easy to set up - state a goal, work out how to reach it, and then say everything that you need to make it happen.

You may know exact what you want for yourself financially, but it’s really difficult to bring those ideas into reality without a plan to follow. Planning for every dollar of our wealth is the only way to track it, and make sure it’s put to best use.

However…

- Act

- …while plans are easy to come up with, it’s a little more difficult to act upon them. Yet the old adage remains true - nothing different will ever happen unless we do things differently.

Sometimes we have trouble taking action because of fear of what will happen next. This is where mindfulness can help us think through situations and prepare ourselves mentally and emotionally for the most likely outcome.

Action isn’t the end of the journey, though, because taking action doesn't necessarily mean that we have achieved a new habit of responsibility. - Reflect

- in order to make sure that our actions are aligned with our plans and choices and that can be made real, reflection is needed.

Reflection is a stage of the journey that many neglect, but it’s essential for maintaining habits of personal responsibility.

It may be helpful to think of reflection as mental refinement. The more we look at something, the better we can understand it and figure out what to do next.

Reflection has a lot in common with acceptance, but where acceptance looks backwards to the past, reflection looks at everything that’s occurred with eye on the future.

- Optimize

- while there’s never really an end to the journey of personal responsibility, when we reach the point where we can use our reflections to optimize our choices, plans and actions, we’ll begin to settle into a new sense of ourselves that takes greater responsibility for our financial situation.

Optimization is how we focus our energy on what we want out of life instead of the unnecessary excuses, denial, and blame. Optimization is the best kind of selfishness, the one that asks, ‘How can I become my best self so that I can create value that helps others?’

This is where we see that the journey of personal responsibility is really a journey towards the greater good, which leads to a wealth of possibilities not just for ourselves, but for everyone around us too.

When you embark on the journey of personal responsibility, remember you only have to take one step at a time to begin making change.

Personal Money Responsibility

And if you’re having trouble working out how to get started, here are a few things you can do now to take greater responsibility with you finances:

- Write down how much you have in the bank versus how much you owe

- Set a financial goal for yourself and compare the goal to your current financial situation

- Construct a plan for your your income to reach your financial goals

- Meditate on your values and search for income opportunities that align with them

- Find a money ally and talk to them about where you are in your journey of personal responsibility

—

Discover more about how to improve your finances through self-improvement techniques every Tuesday at 3:30 p.m. PT during my free live course, Fearless Finance.

SHARE THIS POST

The road to financial freedom is easier when you share the journey. By signing up for Spencer’s newsletter, you’re joining a growing community of people who’ve found their way to “Enough.”