It’s easy for so many of us to believe that we’re just not good with money, especially if we’ve never been given a reason to believe otherwise. But I promise, if you have the desire to improve your financial situation and understand that 2+2=4, then independent wealth is within reach.

This is true even though there’s an aspect of money that’s elusive and beyond anyone’s power. After all, while the richest person in the world has zero power to prevent a market crash, the poorest person can still become a millionaire without possessing so much as a cent.

How? The steps are simple and already known:

- Start with what we have

- Decide where we want to go

- Work out what needs to be done to get there, and

- Take action.

But why is it that, despite possessing this knowledge, so many of us struggle to take the actions that will lead to greater wealth security.

Hidden Money Wisdom

Most Americans already know the secrets of the wealthy even if they don’t know they know.

For instance, one of the concepts millionaires rely on to maximize their wealth is compound interest.

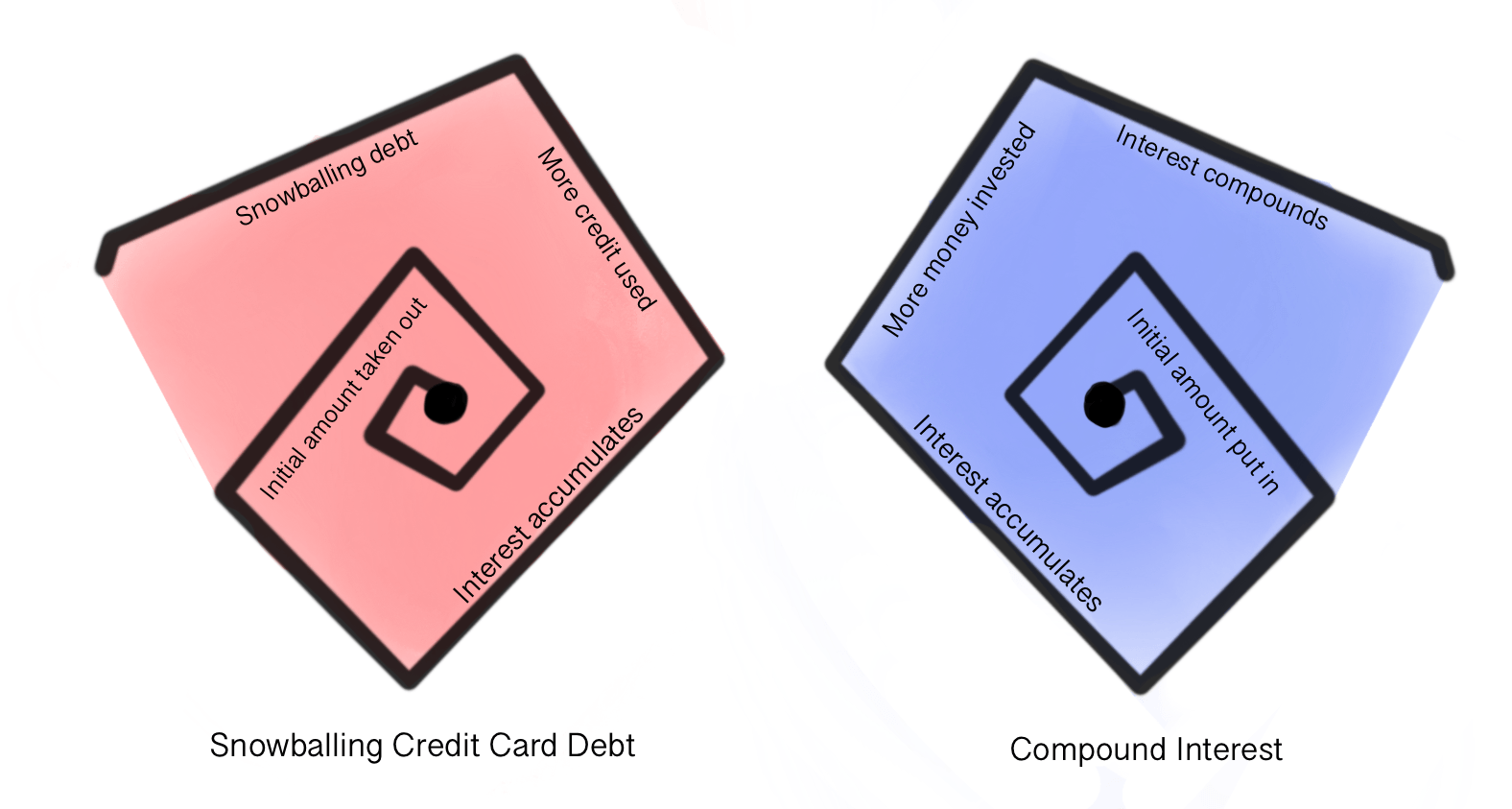

Now, even if you don’t know what compound interest is, you’re probably already familiar with how it works because most of us know its better known dark, evil twin - snowballing credit card debt.

It works like this - the more credit card debt you take out, the more you will owe in interest each month.

Compound interest works the same way but in reverse - the more money you put into a stable investment account, the more you will earn in interest each month.

The same principle is at work, but one reflects spending and the other reflects saving, which leads us to another simple reminder about building wealth - it can only happen when we

save money, not spend it.

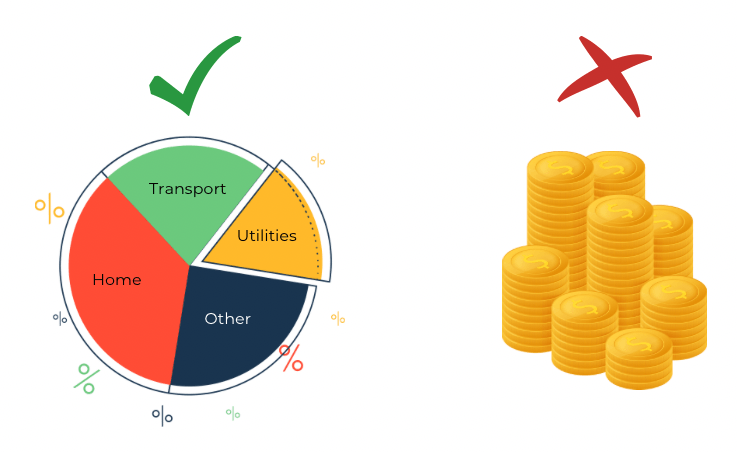

Another example is converting our expenses into percentages. We naturally do this to determine if there are any expenses that we can’t afford.

For example, a deal on a luxury car might feel like a bargain, but if it turns out the payment is 30% of your monthly income, there really aren’t any savings.

Percentages let us see the whole picture, they help us identify unmanageable expenses, and they help us budget better.

Absolute numbers, on the other hand, make it easy to rationalize overspending, invite unhealthy comparisons that compel us to strive for things we can’t afford, and create a false and limited impression of our worth by limiting it to a number.

This is mindful money in practice, and just one example of how a small change in perspective can make a big impact in how we approach our finances.

Money and Identity

So, if we have this hidden money wisdom, why do so many of us still struggle to manage financial fear, anxiety, and in many cases, debt?

The reason so many of us struggle to take the actions that will lead to greater wealth security is because in our culture, money is strongly correlated with identity, and therefore it’s integrated into our psychology.

The process begins early.

Like most things learned in life, money lessons are instilled in us during childhood. As we grow up, we tend to forget we ever learned them, but they stick around and lurk beneath our awareness, influencing our automatic behaviors, responses, and financial decisions.

What’s the solution to get on track to financial independence?

First of all, we need to investigate our early money beliefs, accept them, and make a conscious and dedicated effort to change the habits they’ve ingrained, they will continue to limit our financial possibilities.

Secondly, we need to integrate the new habits needed to improve our financial states by adopting a greater degree of personal responsibility.

—

Uncover more of your hidden money wisdom with me every Tuesday at 3:30 p.m. PT during my free live course, Fearless Finance.

SHARE THIS POST

The road to financial freedom is easier when you share the journey. By signing up for Spencer’s newsletter, you’re joining a growing community of people who’ve found their way to “Enough.”